One Independent, one Republican, and one reluctant Democrat gave Assembly Speaker John Pérez the votes he needed to pass the most contentious piece of his Middle Class Scholarship Act.

Assembly Speaker John Pérez (D-Los Angeles), author of the Middle Class Scholarship Act. (Click to enlarge.)

The Act is a two-bill package consisting of AB 1500 and AB 1501; the latter creates the program while the former establishes the funding source to pay for it. They both have to pass or the Scholarship Act fails and, because they’re urgency bills, both require a two-thirds vote.

Last May, four Republican members of the Assembly joined with Democrats to push AB 1501 over the top, but they all refused to support AB 1500. It would raise about $1 billion a year to fund the scholarship program by eliminating what Democrats says is a loophole that allows multi-state companies to pay lower taxes than California businesses, and what Republicans argue is a tax increase that will make the state less attractive to businesses than it already is.

At the start of yesterday’s Assembly debate, it appeared that AB 1500 would fall short by one, if not two, votes. As recently as Friday afternoon, Republican leaders said it was unlikely anyone in their caucus would cross the aisle, and during the floor debate itself, Democrat Tony Mendoza of Artesia stood to explain why he could not support the bill.

By the time the Assembly voted about an hour later, Pérez had convinced Mendoza to switch, and Republican Assemblymember Brian Nestande of Palm Desert told his GOP colleagues that it was time to do something they “may not normally do.”

“I’m putting forth my effort, my vote, to say we need to come together and work on some of these issues to bring businesses back to California and to grow the economy,” said Nestande, giving the bill the minimum 54 votes it needed. .

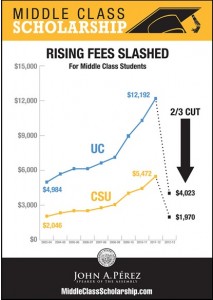

Scholarship amounts at CSU and UC under the Middle Class Scholarship Act. Source: Assembly Speaker John Pérez. (Click to enlarge.)

The Middle Class Scholarship program would provide financial aid to Cal State and University of California students whose family incomes are less than $150,000. The scholarships would cover two-thirds of the tuition at UC and CSU. Based on the current student population, about 150,000 Cal State students would receive over $4,000 a year, and some 42,000 UC students would get nearly $8,200 a year. Community colleges are in for $150 million to help students pay for books, transportation and other college expenses, including fee waivers.

“One of the greatest things that we could do is invest in education,” argued Pérez during his closing comments. “We know that the prosperity of the state has been tied to the success of our public university systems, our great research institutions. When you look at that which has made innovation so successful in California, it’s the co-location of business and great centers of education. This allows us to build on that tradition.”

Republicans vehemently disagreed and said that changing the corporate tax formula could backfire on the very students the scholarship program seeks to help. “I rise in opposition to this bill because it’s a bad idea,” said Twin Peaks Republican Tim Donnelly with characteristic bluntness. “We are literally investing in education and there aren’t going to be any jobs for these kids because we keep driving businesses out of the state with unfriendly policies.”

Staying single

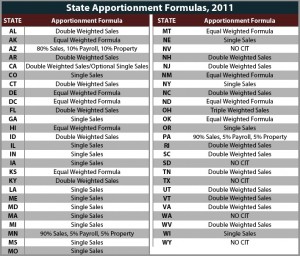

Until last year, companies headquartered out of state but doing business here had to compute their California taxes based on three factors: sales, property, and workforce or payroll. But California companies argued that the formula wasn’t fair to them because multi-state businesses could reduce their tax burden by not creating new jobs or expanding manufacturing facilities in the state.

In an effort to equalize the tax burden, the Legislature changed the law to base taxes solely on sales, a method known as the Single Sales Factor. In February 2009, in a closed-door, middle-of-the-night deal to win Republican support for the budget, Democratic leaders also gave the out-of-state businesses the option of choosing whichever formula gave them the lowest tax bill.

In a May 2010 brief, the Legislative Analyst’s Office estimated that this tax choice would cost the state about $1 billion a year in revenues and continue the inequitable treatment of California companies.

“With most states’ formulas now based only on sales, the old formula that used property and payroll could put some California producers at a competitive disadvantage. Allowing firms to choose their formula every year arbitrarily favors some firms over others,” wrote the Legislative Analyst.

Multi-state tax formulas across the country. (Pennsylvania’s vote came too late for this chart). Source: Institute on Taxation and Economic Policy, August 2011. (Click to enlarge.)

California has been out of step with the national bipartisan trend on this issue. Seventeen states, including Texas, New York, and New Jersey, have enacted a mandatory Single Sales Factor rate. Last month, Pennsylvania’s Republican Governor Tom Corbett signed his state’s law.

Gov. Jerry Brown would like to have that same opportunity, and he tried last year with ABX1 40. But neither that bill nor SB 116, a similar one introduced in the Senate by Los Angeles Democrat Kevin De León, made it out of their houses of origin.

The same coalition of automakers, Chambers of Commerce, and manufacturers that blocked the last two measures are lobbying against AB 1500 this session. In a memo to members of the state Assembly two months ago, they wrote that while the goal of the Scholarship Act is laudable, changing the tax “will further erode California’s ability to attract and compete with other states for business investment and hiring.”

Independent Nathan Fletcher of San Diego. Source: California Channel video. (Click to enlarge.)

But opposition to a mandatory Single Sales Factor formula isn’t universal among businesses in the state. A number of large high-tech companies, including Genentech, Qualcomm, Cisco, and BIOCOM, have announced their support for Pérez’ bills.

Nathan Fletcher, the Legislature’s only Independent, whose San Diego district includes Qualcomm, admonished Republican members for being more interested in helping giant out-of-state corporations, like the automakers Chrysler and General Motors, than in supporting local business and students.

“At the end of the day, every vote we take up here is about choices and about values,” Fletcher said to his colleagues, “and the choice before you today is clear: you’re either going to stand with California employers or with out-of-state employers; you’re either going to stand with California students or with out-of-state employers.”

There is also a competing measure, of sorts, coming up before voters this election day. Proposition 39, known as the California Clean Energy Jobs Act, would, like AB 1500, make the Single Sales Factor mandatory. However, instead of investing the revenue in a middle-class scholarship program, the money would fund projects that create clean energy jobs. Some money would also go into the state general fund, where it would make its way to education through the regular channels.

But Prop 39 spokesperson Alexa Bluth said it’s unlikely that both AB 1500 and the initiative would be enacted. “If AB 1500 passes, we will stand down from pushing for Proposition 39,” wrote Bluth in an email to EdSource Today.

AB 1500 and its companion bill, AB 1501, have passed their first challenge and are now in the Senate, but there, too, Democrats are two votes short of the necessary two-thirds needed to pass the Middle Class Scholarship Act. As one official commented, “To my knowledge, the Senate has no Nestandes or Fletchers.”

To get more reports like this one, click here to sign up for EdSource’s no-cost daily email on latest developments in education.

Comments (1)

Comments Policy

We welcome your comments. All comments are moderated for civility, relevance and other considerations. Click here for EdSource's Comments Policy.

Tom Lopinski 12 years ago12 years ago

When will the Republicans quit protecting big business and finally do something for the middle class by passing AB 1500? Who do we need to contact to stop this madness?