A girl plays at the water table in her state-funded Montessori preschool classroom in East Palo Alto on March 28, 2013. Obama’s proposed budget would provide funding to expand programs like this one. Credit: Lillian Mongeau, EdSource Today

In an ambitious and highly anticipated budget plan, President Barack Obama called Wednesday for allocating $75 billion over the next 10 years to expand public preschool by raising the federal tax on tobacco products.

The plan offered the first concrete proposal for funding the “Preschool for All” initiative the president introduced in his State of the Union address in January. If approved, it would be the largest influx of federal funding for preschool since Head Start – which now provides nearly $8 billion for early education programs for children living in poverty – was initiated in 1965.

Still, the president’s proposal faces a tough fight in a fractured Congress focused on trimming a massive federal deficit.

“We do not believe increasing taxes to grow government programs is the best course for our country,” said Rep. Ken Calvert, R-Corona, a member of the House Budget Committee, in a statement. Calvert said he would oppose any proposal to expand government programs or increase taxes, including the tobacco tax the president is proposing to pay for expanded preschool.

Obama called for increasing the tax on tobacco products to $1.95 per pack, up from $1.01. The new tax would fund a grant program that would allow states to expand their public preschool programs for 4-year-olds from low- and moderate-income families – those making up to about $47,100 a year for a family of four.

Additionally, the budget allocates $750 million in competitive “Preschool Development Grants” to be distributed in 2014 to states that want to expand their preschool offerings.

“We’re really excited to see the president make good on his State of the Union commitment to make early learning a priority,” said Catherine Atkin of Early Edge California, an advocacy and lobbying organization focused on expanded early education programs in the state.

She added, “We know that with one out of eight children in the country living in California, we stand to be big winners.”

If Obama’s proposal is adopted, any new preschool offerings would likely come in the form of an expansion to the state’s current preschool program, which is funded from the money in the state’s general fund earmarked for education. The federally funded Head Start program also offers public preschool in the state. Both programs are targeted for the children from the same low- and moderate-income families who would be eligible for services under Obama’s new proposed program. Collectively, the two programs serve more than 300,000 children. Both programs report long waiting lists.

State preschool and child care programs have been slashed by $1 billion since the beginning of the economic recession, resulting in fewer slots. Gov. Jerry Brown’s proposed budget would keep early education funding in California flat for fiscal year 2013-2014.

Head Start programs are also facing shrinking grants under the federal sequester cuts and expect to serve as many as 6,000 fewer children in California by this time next year. The president’s proposal could signal a change for Head Start as well: As 4-year-olds begin to enroll in classrooms funded by Preschool for All grants, the U.S. Department of Education recommends that Head Start shift its focus to infants and toddlers.

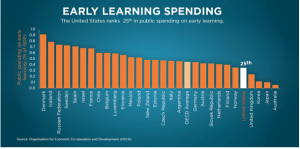

Click to enlarge. Source: The U.S. Department of Education displayed this graph on its early learning site. Data is from the Organisation for Economic Co-operation and Development (OECD)

Supporters of the president’s proposal are optimistic about the possibility of passage. Kris Perry, executive director of the national First Five Years Fund, which advocates for increased programming and spending on early childhood programs across the country, said that tobacco taxes have passed in 47 states and stand a good chance at the national level—although they anticipate a tough fight.

“I don’t want to be Pollyanna,” Atkin said. “The tobacco tax and the tobacco lobby in Congress is formidable. We are going to have to be very focused and beat the drum for this proposal.”

Advocates are also aware of a potential catch in relying on tobacco tax revenue. One much touted side benefit of tobacco taxes – that they help lower tobacco consumption – raises the risk of a steadily shrinking funding stream. But Atkin hopes that by the time that happens, the preschool programs would have proven their benefit enough to warrant ongoing funding.

In the meantime, California preschool advocates have already launched a concerted effort to ensure the state is ready to apply for federal funding for expanded preschool programming should money become available. Last week, a coalition of superintendents penned an open letter to Obama supporting his Preschool for All initiative and outlining how they would get their districts ready to partner with the federal government to expand preschool access.

Assemblymember Susan Bonilla, D-Concord, introduced a resolution, to be heard before the Assembly Education Committee on May 1, stating support for the president’s proposal and encouraging the California Department of Education to prepare a plan for expanding California’s state preschool program.

“It was good news to hear that concrete plans are coming forward,” Bonilla said. “It shows (Obama’s) commitment to carrying through on his goals.”

To get more reports like this one, click here to sign up for EdSource’s no-cost daily email on latest developments in education.

Comments (11)

Comments Policy

We welcome your comments. All comments are moderated for civility, relevance and other considerations. Click here for EdSource's Comments Policy.

Cathy Holtz 11 years ago11 years ago

NO, I will not support a matching state tax for marijuana to fund preschool $75B tobacco products. Look on the whitehouse.gov under marijuana! ILLEGAL It is an offense under Federal Law smoking marijuana - a controlled substance under CSA. Federal Law states there is no such "medical" marijuana. The DOJ guidelines do not legalize marijuana. What message does this send to the children the schools are teaching - I want the children … Read More

NO, I will not support a matching state tax for marijuana to fund preschool $75B tobacco products.

Look on the whitehouse.gov under marijuana! ILLEGAL It is an offense under Federal Law smoking marijuana – a controlled substance under CSA. Federal Law states there is no such “medical” marijuana. The DOJ guidelines do not legalize marijuana.

What message does this send to the children the schools are teaching – I want the children to be healthy with their body and brain.

ruben 11 years ago11 years ago

President Obama is basing the proposed preschool programs upon Prop 10 - the California First 5 program. Maybe preschool could be a decent idea, but for pete's sake, do not base any such federal law on the completely dysfunctional First 5's - 20 forced resignations and over $300 million recently admittedly directed to be spent illegally is tax dollar malfeasance. There's a lot wrong with the structure of that law - let's not make the same … Read More

President Obama is basing the proposed preschool programs upon Prop 10 – the California First 5 program.

Maybe preschool could be a decent idea, but for pete’s sake, do not base any such federal law on the completely dysfunctional First 5’s – 20 forced resignations and over $300 million recently admittedly directed to be spent illegally is tax dollar malfeasance. There’s a lot wrong with the structure of that law – let’s not make the same mistake twice.

Check out the First 5 watchdog site at FLOPPED5

Replies

Paul 11 years ago11 years ago

Ruben, thanks for this reference. FLOPPED5 is hilarious, but a little nit-picky even for me. I have seen some worthwhile, teacher-initiated projects, such as kindergarten pre-assessment and kindergarten orientation, funded through First 5. It can’t be all bad.

Paul 11 years ago11 years ago

I’m sorry, Lillian, my last post was a tongue-in-cheek response to the choice of a problematic funding source for, and to the increased regulation of, preschool. I was poking fun at a mix of state and federal rules on funding and quality for K-12 education. Eric started it. 🙂

Just me 11 years ago11 years ago

It would all be grand if it actually did what it is supposed to do. We currently have UPK in our district and also have one of the highest income brackets in the area. Many people are making 6 figures and getting free preschool. How does it make sense?? Use it for what it is intended. Make it based on income not first come first serve. Because in my district that's what it is. Then you … Read More

It would all be grand if it actually did what it is supposed to do.

We currently have UPK in our district and also have one of the highest income brackets in the area. Many people are making 6 figures and getting free preschool. How does it make sense?? Use it for what it is intended. Make it based on income not first come first serve. Because in my district that’s what it is. Then you go on a wait list if you don’t get a spot. However between 2 friends of mine here was the situation

Family 1 – 125,000.00 a year. Child got into UPK.

Family 2 – 60,000.00 a year. Child on wait list.

Next community over very impoverished. How many spots did they get? And why not send the amounts over there. Someone making even 60,000 doesn’t need UPK.

Replies

el 11 years ago11 years ago

Although I think the situation you describe sounds sad - and it's not universal free preschool if there aren't enough slots for all the kids - I think that all parents need quality slots available for their kids regardless of income, and that the school as a whole benefits if all kids from the community are welcomed, rather than excluding middle and high income kids. Excluding high income kids from public preschool makes no more sense … Read More

Although I think the situation you describe sounds sad – and it’s not universal free preschool if there aren’t enough slots for all the kids – I think that all parents need quality slots available for their kids regardless of income, and that the school as a whole benefits if all kids from the community are welcomed, rather than excluding middle and high income kids.

Excluding high income kids from public preschool makes no more sense than excluding them from kindergarten or 5th grade.

Paul 11 years ago11 years ago

Well said, ReillyFam. Erick, I have the same fear as you but almost didn't want to raise it. The other recent article about "staffing" the new preschools also points to increased regulation, which could be good if realistic, reasonable and adequately funded, terrible if unrealistic, nreasonable, or unfunded. So, if your local state-subsidized preschool falls into Program Improvement, are you entitled to transfer your child to a preschool with a higher API? And if your community happens … Read More

Well said, ReillyFam.

Erick, I have the same fear as you but almost didn’t want to raise it. The other recent article about “staffing” the new preschools also points to increased regulation, which could be good if realistic, reasonable and adequately funded, terrible if unrealistic, nreasonable, or unfunded.

So, if your local state-subsidized preschool falls into Program Improvement, are you entitled to transfer your child to a preschool with a higher API? And if your community happens to have a low smoking rate (as compared to a community with “basic aid”/”excess revenue” preschools), will the state make up the difference in revenue? And can preschool teachers who haven’t taken a college course in the US constitution be considered “highly qualified” under NTLB (No Toddler Left Behind)?

Replies

Lillian Mongeau 11 years ago11 years ago

The proposed tobacco tax is an increase of the federal excise tax. That means smokers would pay $1.95 to the federal government on top of the price of a pack and whatever state or local taxes might already be levied on tobacco products in a given region. (Right now, they pay $1.01 to the feds on each pack.) That means the $75 billion over 10 years discussed in the article would be raised by the federal … Read More

The proposed tobacco tax is an increase of the federal excise tax. That means smokers would pay $1.95 to the federal government on top of the price of a pack and whatever state or local taxes might already be levied on tobacco products in a given region. (Right now, they pay $1.01 to the feds on each pack.)

That means the $75 billion over 10 years discussed in the article would be raised by the federal government and doled out to states in an as-yet not clarified method for states to create or expand their preschool programs.

All of which is to say, areas of the country with lower smoking rates would not lose out on these funds. So there would be no need for the state to make anything up based on smoking rates.

Eric Premack 11 years ago11 years ago

Can’t wait for the feds to begin defining “adequate yearly progress” for preschoolers.

ReilleyFam 11 years ago11 years ago

Why should smokers pay for daycare? What about smoking necessitates that smokers, and smokers alone, pay for this? This is nothing more than prejudice against smokers and making them pay for something completely unrelated to addiction or the effects of smoking.

Paul 11 years ago11 years ago

"Surgeon General's Warning: Smoking during pregnancy causes birth defects but pays for your preschool." I am glad that the administration recognizes the declining trajectory of this revenue stream, and sad that our nation has to resort to this sort of exceptional tax gimmick to fund a promising component of the educational system. (One could also argue, since preschool is an expense incurred early in the life of a child, that parents who know they won't be … Read More

“Surgeon General’s Warning: Smoking during pregnancy causes birth defects but pays for your preschool.”

I am glad that the administration recognizes the declining trajectory of this revenue stream, and sad that our nation has to resort to this sort of exceptional tax gimmick to fund a promising component of the educational system. (One could also argue, since preschool is an expense incurred early in the life of a child, that parents who know they won’t be able to afford it should postpone parenthood until their financial means improve. Would parents choose to send their children if the program weren’t free? Let us hope!)